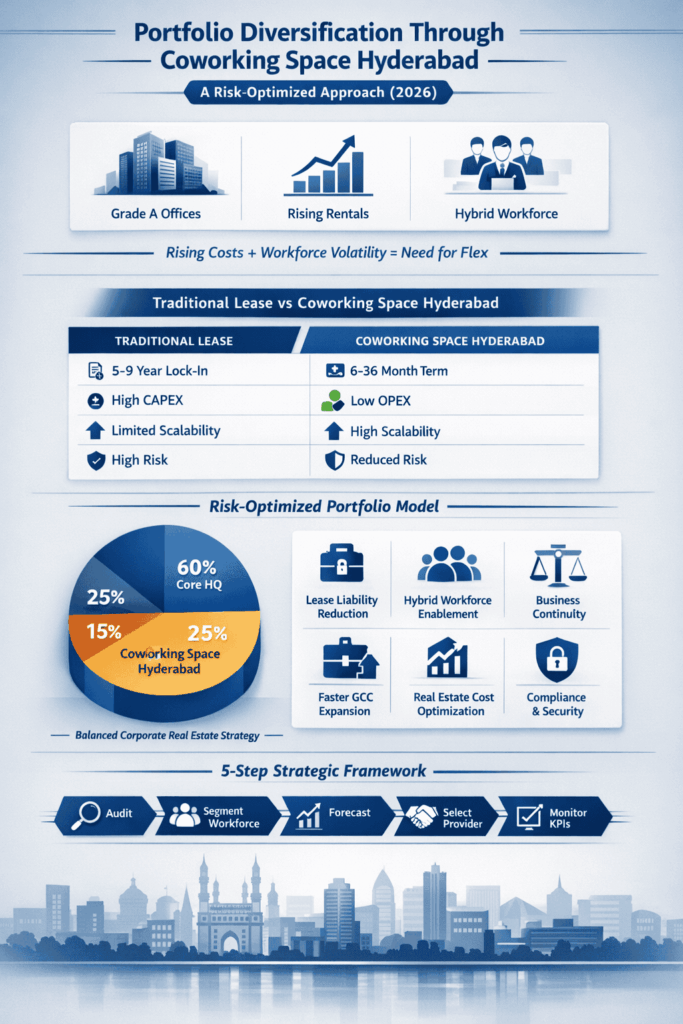

Corporate real estate strategy is entering a new phase. In 2026, enterprises are no longer optimizing only for cost they are optimizing for resilience, scalability, and financial agility.

Traditional long-term leases in commercial office space Hyderabad once offered stability. However, rising rentals, hybrid workforce variability, and evolving expansion cycles are exposing concentration risks in fixed office portfolios.

This is where coworking space Hyderabad becomes a strategic asset. Instead of viewing flexible offices as temporary solutions, enterprises are now integrating coworking space Hyderabad into long-term portfolio planning to reduce financial exposure and improve operational continuity.

Hyderabad remains one of India’s strongest commercial markets, driven by IT/ITES, BFSI, life sciences, and Global Capability Centers (GCCs). However, market maturity brings new challenges:

As a result, enterprises are increasingly adopting flexible office space Hyderabad solutions. According to recent market observations, enterprise demand for managed office space Hyderabad continues to rise, particularly among multinational corporations and PE-backed firms.

Against this backdrop, coworking space Hyderabad is emerging as a viable portfolio diversification tool.

Portfolio diversification in CRE refers to distributing workspace investments across different formats to reduce concentration risk.

A modern enterprise portfolio typically includes:

Instead of committing 100% of seats to rigid leases, companies are allocating 20–40% of capacity to coworking space Hyderabad providers. This ensures adaptability without compromising operational standards.

Traditional commercial office space Hyderabad agreements often require 5–9 year lock-ins with escalation clauses. During headcount corrections, companies may face underutilized space and high exit penalties.

By integrating coworking space Hyderabad into their portfolio, enterprises can:

For CFOs, this shifts the financial structure from fixed CAPEX-heavy commitments to scalable OPEX models.

Conventional office setups require:

In contrast, enterprise-ready coworking space Hyderabad offers fully furnished, plug-and-play environments. This converts capital expenditure into operating expenditure, enabling more agile capital allocation.

This model is particularly beneficial for GCC office space Hyderabad expansion strategies, where speed-to-market and financial prudence are critical.

Hybrid work has fundamentally changed space utilization patterns. Peak occupancy is no longer consistent, and enterprises must align real estate with fluctuating attendance.

Coworking space Hyderabad supports hybrid workplace strategies by offering:

Unlike rigid leases, flexible office space Hyderabad allows enterprises to recalibrate space requirements quarterly or annually.

For CHROs, this ensures workplace experience remains aligned with employee expectations while preserving operational efficiency.

Operational resilience is now central to enterprise planning. Concentrating the workforce in a single campus increases exposure to localized disruptions.

A diversified portfolio that incorporates coworking space Hyderabad across multiple business districts enables:

Flexible workspace solutions Hyderabad therefore function not only as expansion tools but as risk mitigation assets.

Enterprise leaders evaluating coworking space Hyderabad must prioritize governance and compliance.

Modern enterprise coworking space Hyderabad providers typically offer:

When selecting managed office space Hyderabad, enterprises should conduct compliance audits covering fire safety certifications, data privacy safeguards, and infrastructure redundancy.

The coworking model has matured significantly, and many providers now align closely with Grade A commercial standards.

| Parameter | Traditional Lease | Coworking Space Hyderabad |

|---|---|---|

| Lock-in Period | 5–9 years | 6–36 months |

| Fit-Out Investment | High | Minimal |

| Time to Occupy | 4–8 months | Immediate |

| Scalability | Limited | High |

| Risk Exposure | Concentrated | Distributed |

From a real estate cost optimization Hyderabad perspective, blending both models creates financial balance and agility.

Global Capability Centers entering India increasingly adopt phased expansion models.

Phase 1 typically includes:

This approach minimizes entry risk while preserving flexibility. As operations stabilize, enterprises maintain a hybrid core-flex structure rather than reverting entirely to long-term leases.

Talent retention is directly linked to workplace quality. Premium coworking space Hyderabad environments now provide:

For CHROs, corporate coworking Hyderabad solutions enhance employer branding and employee engagement while aligning with hybrid workforce strategies.

To effectively integrate coworking space Hyderabad, enterprises can follow this structured approach:

Evaluate long-term financial liabilities and underutilized space.

Allocate dynamic teams to flexible office space Hyderabad solutions.

Incorporate hiring, automation, and hybrid adoption scenarios.

Ensure compliance, IT security, and SLA transparency.

Measure utilization, cost per seat, and employee satisfaction.

This systematic integration ensures coworking space Hyderabad strengthens, rather than disrupts, portfolio stability.

The future of corporate real estate in Hyderabad is not about abandoning traditional leases it is about balancing them.

By integrating:

enterprises can create a resilient, scalable, and financially optimized portfolio.

In 2026 and beyond, coworking space Hyderabad is no longer a tactical stopgap. It is a strategic instrument for risk-optimized growth, hybrid workforce enablement, and long-term corporate agility.