Corporate real estate leaders are under pressure. Rising occupancy costs, hybrid work variability, and capital efficiency mandates are reshaping how enterprises think about space. In 2026, Corporate Real Estate Optimization is no longer a cost-cutting initiative it is a strategic business lever.

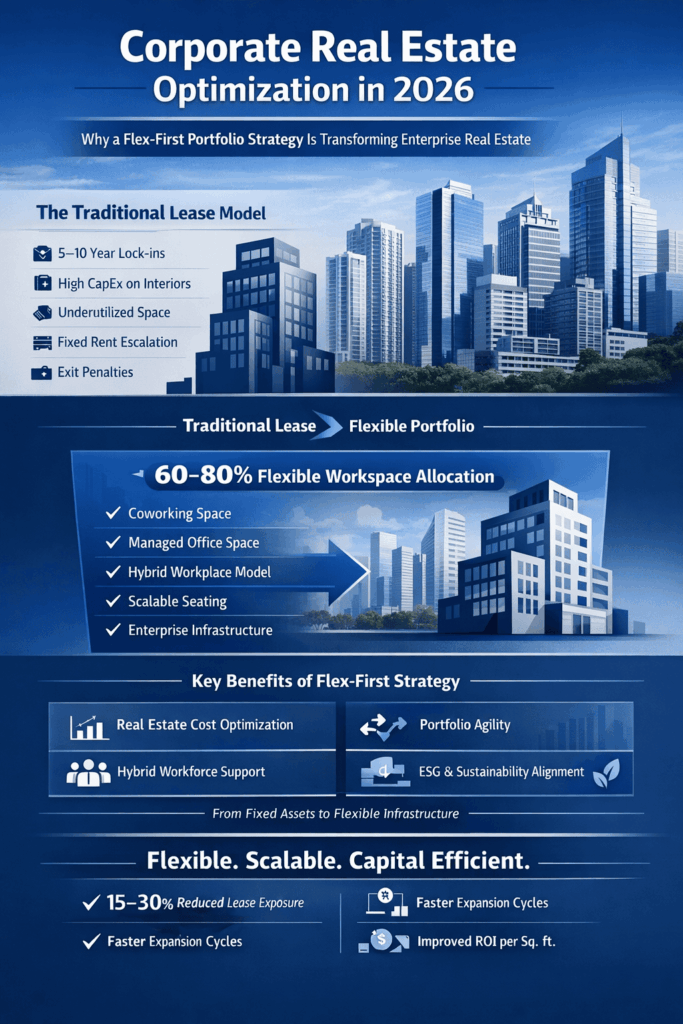

The data is clear: static, long-term lease-heavy portfolios are losing relevance. Enterprises are transitioning toward a flex-first portfolio strategy, where Coworking Space, managed offices, and flexible workspace solutions form the foundation of the corporate real estate portfolio.

This is not a temporary adjustment. It is a structural shift in how companies allocate capital, manage risk, and support workforce performance.

Corporate Real Estate Optimization refers to the strategic alignment of workplace assets with business goals, cost structures, and workforce behavior.

In 2026, optimization includes:

Traditional models assumed predictable growth and stable headcount. Today’s enterprises operate in expansion-contraction cycles driven by market volatility, global hiring patterns, and digital transformation initiatives.

A portfolio dominated by long-term leases introduces risk. A flex-first model reduces it.

Long-term leases were built for stability. Modern enterprises require agility.

Challenges with traditional portfolios:

Corporate CFOs now evaluate real estate through a capital allocation lens. Idle square footage is not just inefficient it is a balance sheet burden.

This is where Coworking Space and managed office solutions offer structural advantages.

A flex-first portfolio strategy prioritizes flexible office space as the primary component of corporate real estate.

Instead of allocating a small percentage to flexible workspace, leading enterprises are shifting 60–80% of their footprint to:

This shift improves:

The flex-first approach is particularly effective in high-growth cities such as Bangalore, where enterprise expansion and technology hiring fluctuate rapidly.

The perception that Coworking Space is only for startups is outdated. In 2026, enterprise coworking models are designed for scale, security, and customization.

Enterprise-grade Coworking Space offers:

This model converts capital-heavy assets into service-driven operating expenses.

Cost remains central to Corporate Real Estate Optimization.

Flexible workspace reduces financial friction. It aligns occupancy costs directly with workforce size.

Hybrid workplace strategy demands adaptability. On any given day, office attendance fluctuates. Static portfolios cannot adjust in real time.

A flex-first strategy allows companies to:

Coworking Space operators with multiple centers in business corridors enable distributed workforce strategies without additional capex.

Managed office space bridges the gap between conventional leases and shared coworking environments.

Unlike hot-desking environments, enterprise managed offices provide:

Providers such as GoodWorks have positioned managed offices within Grade A commercial buildings, aligning premium workspace design with operational efficiency.

With 65–75 sq. ft. per seat, GoodWorks offers one of the highest space allocations in the Indian Coworking Space industry directly supporting productivity and employee comfort.

Corporate real estate decisions are now backed by analytics.

Key utilization metrics include:

Flexible office space allows real-time adjustments based on data. Instead of paying for assumed growth, enterprises pay for actual usage.

This precision reduces waste and improves long-term portfolio efficiency.

Environmental compliance is influencing corporate real estate decisions in 2026.

Flex-first portfolios support ESG objectives by:

Coworking Space within certified commercial developments reduces environmental impact without additional capital investments.

As India’s technology and GCC hub, Bangalore is driving enterprise adoption of flexible office space.

Key drivers include:

Companies require scalable, premium-grade office environments without long lock-ins. This environment strengthens the case for flex-first portfolio strategies across sectors.

When implemented effectively, Corporate Real Estate Optimization through flexible workspace can deliver:

Most importantly, it improves balance sheet flexibility a priority for CFOs managing volatile economic cycles.

Before renewing or signing a traditional lease, decision-makers should evaluate:

If the answers indicate rigidity, the portfolio requires restructuring.

In 2026, Corporate Real Estate Optimization is defined by flexibility, capital discipline, and workforce-centric design.

A flex-first portfolio strategy:

Coworking Space and managed office solutions are no longer alternatives — they are foundational assets in enterprise real estate strategy.

The shift toward a flex-first portfolio strategy is not optional. It is a structural response to workforce evolution, capital discipline, and operational uncertainty.

Corporate real estate leaders who prioritize Corporate Real Estate Optimization through managed office space and premium Coworking Space models will build portfolios that are resilient, scalable, and financially aligned with business growth.

Enterprises that delay this transition risk being locked into outdated, inflexible assets in a market that now rewards adaptability.

Book a Corporate Real Estate Strategy Consultation

Speak with our enterprise workspace experts.